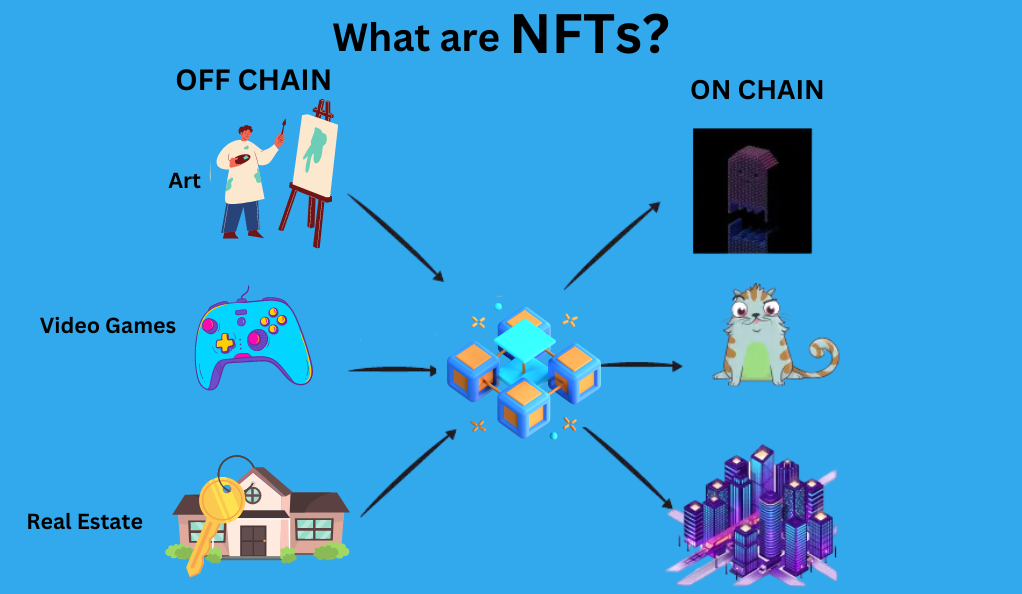

What Are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital assets that represent ownership or proof of authenticity of a specific item. Unlike cryptocurrencies like Bitcoin, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique and cannot be exchanged at equivalency. Imagine owning a one-of-a-kind painting; that’s what an NFT is in the digital world. This uniqueness has led to a surge in interest in NFTs, especially among collectors and digital artists.

Why Are NFTs Important?

NFTs have revolutionized the way we perceive ownership and value in the digital realm. They enable artists, musicians, and creators to monetize their work in ways never before possible. For collectors, NFTs offer a new avenue to invest and engage with unique digital content. The importance of NFTs extends beyond mere ownership; they are changing the dynamics of digital interaction and commerce.

How to Start Investing in NFTs

Choosing the Right Platform

Investing in NFTs begins with selecting the right platform. Various marketplaces cater to different types of NFTs, including art, music, virtual real estate, and more. Researching and understanding the platform’s reputation, fees, and community engagement is crucial. The choice of platform can greatly influence the success of your investment, so take the time to find one that aligns with your interests and values.

Understanding Wallets and Cryptocurrencies

Investing in NFTs requires a basic understanding of digital wallets and cryptocurrencies. These are the building blocks of any NFT transaction. Without a wallet and the right cryptocurrency, you cannot buy or sell NFTs.

- Types of Wallets

There are two main types of wallets: hot wallets (online) and cold wallets (offline). Hot wallets are more convenient but less secure, while cold wallets offer more security but are less accessible. Understanding the trade-offs between these two types of wallets is essential for managing your digital assets effectively.

- Cryptocurrencies Used in NFT Transactions

Most NFT transactions are conducted using cryptocurrencies like Ethereum. Understanding how to purchase and use these cryptocurrencies is essential for any NFT investor. Different platforms may use different cryptocurrencies, so it’s important to know which ones are accepted where you plan to invest.

Exploring the NFT Market

Popular NFT Categories

From digital art to virtual real estate, the NFT market is diverse. Understanding different categories helps investors identify opportunities that align with their interests and investment goals. Whether you’re interested in virtual collectibles or groundbreaking digital art, there’s likely an NFT category that resonates with you.

Identifying Potential Investments

Research, networking, and staying updated with market trends are vital in identifying promising NFT investments. Engaging with creators and other investors can provide valuable insights. Don’t be afraid to ask questions and seek guidance from experienced investors. The more you learn, the better your investment decisions will be.

Risks and Challenges

Legal Considerations

NFT investments come with legal considerations, such as intellectual property rights and taxation. Consulting with legal professionals is advisable. Understanding the legal landscape can help you navigate potential pitfalls and ensure that your investments are compliant with relevant laws and regulations.

Market Volatility

The NFT market is highly volatile. Prices can skyrocket but can also plummet without warning. Understanding this risk is essential for any investor. Diversifying your portfolio and staying informed about market trends can help mitigate some of this volatility.

Conclusion

Investing in NFTs is an exciting and innovative field, but it requires careful consideration, research, and understanding. From choosing the right platform to understanding the risks, this guide provides a comprehensive overview for new NFT investors. The world of NFTs is vast and ever-changing, and with the right approach, it can be a rewarding investment opportunity.

FAQs

1. What is the difference between NFTs and cryptocurrencies?

NFTs are unique digital assets, while cryptocurrencies are fungible digital currencies.

2. How can I start investing in NFTs?

Start by choosing a reputable platform, setting up a digital wallet, and understanding the cryptocurrencies used in NFT transactions.

3. Are NFTs a safe investment?

Like any investment, NFTs come with risks. Understanding these risks and conducting thorough research is essential.

4. Can I create my NFTs?

Yes, creators can mint their NFTs on various platforms, allowing them to monetize their digital creations.

5. What are the legal considerations when investing in NFTs?

Legal considerations include intellectual property rights, taxation, and compliance with local regulations.